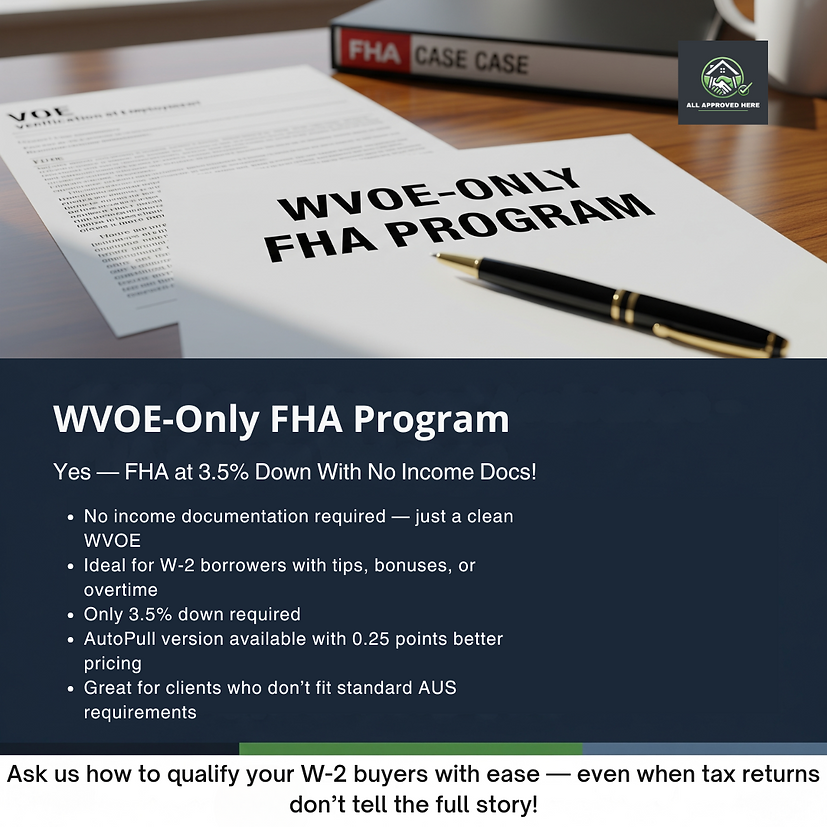

WVOE-Only FHA Program

Fast FHA Financing with No Income Documentation Required

Qualify FHA buyers quickly and easily without the hassle of traditional income paperwork. This program uses a clean Written Verification of Employment (WVOE) to approve W-2 borrowers, making it perfect for clients with variable income streams like tips, bonuses, or overtime who may not fit standard AUS guidelines.

FAQs

Who is eligible for the WVOE-Only FHA Program?

Any W-2 borrower whose income can be verified directly with an employer through a clean WVOE.

Can self-employed borrowers use this program?

No, this program is specifically for W-2 wage earners.

What does “clean WVOE” mean?

It means the verification of employment matches the borrower’s stated income without discrepancies.

Are there credit score requirements?

Yes — standard FHA minimum credit requirements apply.

How long does approval take?

With a clean WVOE, approvals can be issued in days rather than weeks.

Can this be combined with down payment assistance?

Yes, in many cases it can be paired with eligible FHA down payment assistance programs.

Why This Program Works for W-2 Borrowers

Many strong W-2 buyers lose out on homeownership opportunities because tax returns don’t accurately reflect their real earning potential. This program sidesteps that problem by verifying employment directly with the employer — no pay stubs, tax returns, or extra income documents required. It’s a faster, more flexible option for clients with variable or hard-to-document earnings.

A Smarter Way to Get Approved

Instead of waiting weeks for traditional underwriting to review tax returns, borrowers can close faster by submitting just a WVOE. This means less paperwork, quicker decisions, and a better client experience.

.png)