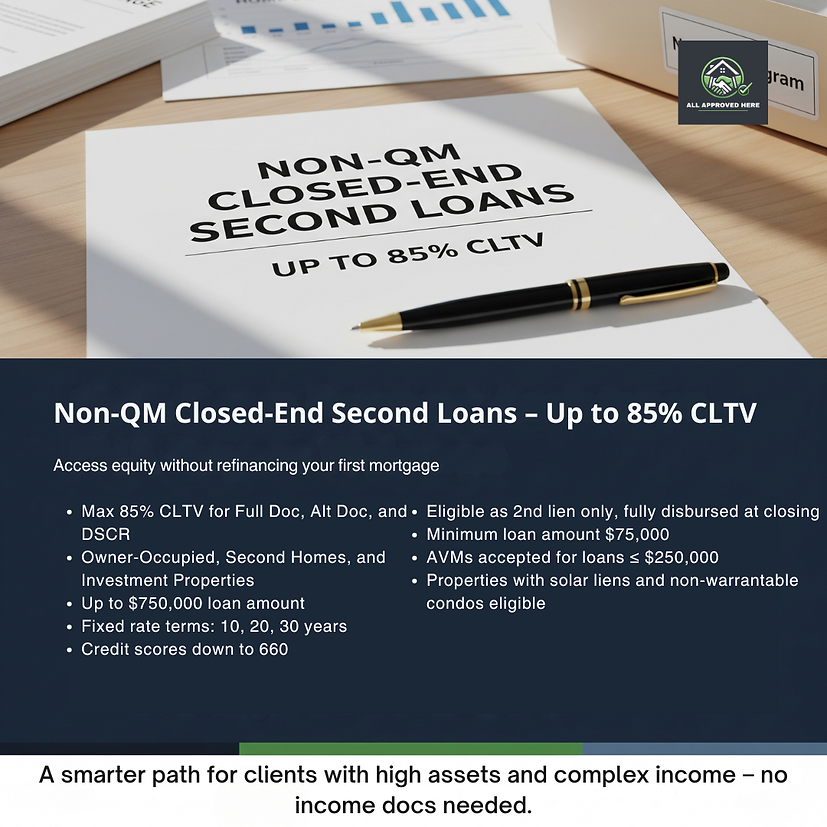

Non-QM Closed-End Second Loans – Up to 85% CLTV

Access equity without refinancing your first mortgage

Perfect for borrowers who want to tap into their home’s value while keeping their existing first loan in place. This program offers flexible options for various property types and documentation methods.

FAQs

Q: What’s the maximum CLTV allowed?

A: Up to 85% for Full Doc, Alt Doc, and DSCR loans.

Q: What property types are eligible?

A: Owner-occupied, second homes, and investment properties, including some non-warrantable condos.

Q: How much can I borrow?

A: Up to $750,000 loan amount, with a minimum loan size of $75,000.

Q: Are solar lien properties eligible?

A: Yes, properties with solar liens can be eligible.

Q: Is an appraisal required?

A: AVMs are accepted for loans up to $250,000.

Why This Program Works

This second lien option allows clients to preserve their low first-mortgage rate while still unlocking substantial equity. With high CLTV limits, multiple documentation options, and eligibility for investment properties, it’s a strategic solution for cash needs. Flexible terms and acceptance of solar lien and unique condo properties make it accessible for more borrowers.

A Smarter Way to Refinance without Refinancing Your First Mortgage

Tap into equity without disturbing the first mortgage — great for debt consolidation, investment opportunities, or major expenses. Maintain favorable first-mortgage terms while securing competitive financing for additional needs.

.png)