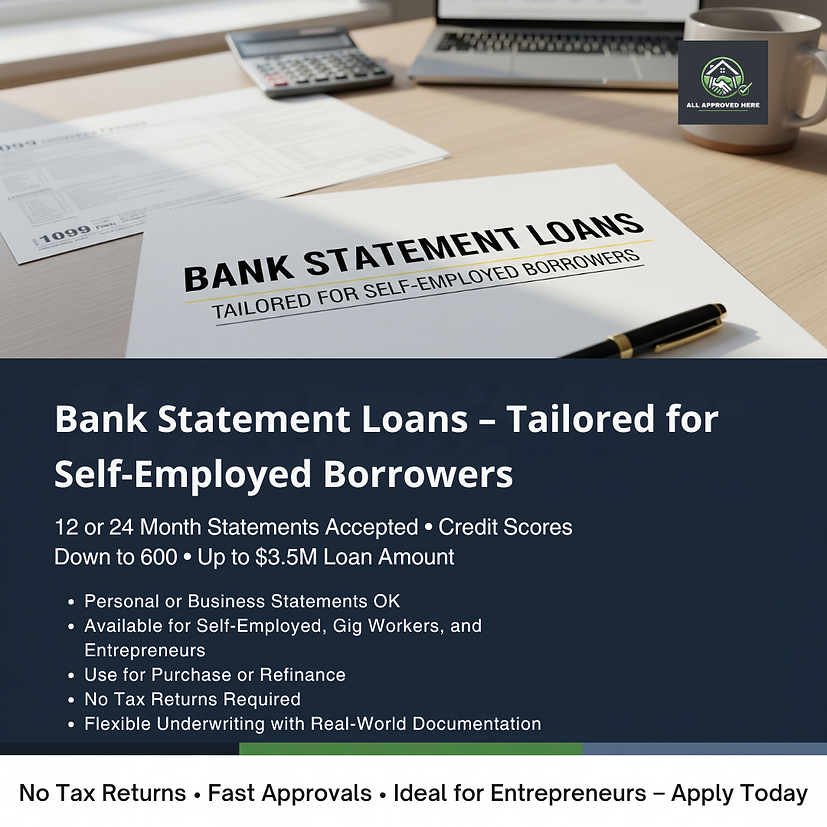

Bank Statement Loans – Tailored for Self-Employed Borrowers

Flexible Documentation for Entrepreneurs and Independent Earners

For self-employed borrowers, gig workers, and entrepreneurs who don’t fit traditional lending guidelines, our Bank Statement Loan program offers a streamlined path to approval. With the option to use 12 or 24 months of personal or business bank statements, you can qualify without tax returns. Credit scores starting at 600 are accepted, and loan amounts go up to $3.5 million. Whether you’re purchasing or refinancing, this program is designed for real-world income situations with flexible underwriting.

FAQs

Do I need to provide tax returns?

No — qualification is based on your bank statements instead of tax returns.

Can I use either personal or business statements?

Yes, both personal and business statements are accepted.

What types of properties are eligible?

Primary residences, second homes, and investment properties.

What is the maximum loan amount?

Up to $3.5 million.

Is this program available for refinancing?

Yes, you can use it for both purchase and refinance transactions.

How is income calculated?

We use a standard expense ratio — typically 50% for bank statement analysis unless otherwise documented.

Why This Program Works for Self-Employed Borrowers

Self-employed professionals often face challenges when applying for traditional loans due to write-offs and complex income structures. This program bypasses those issues by focusing solely on your actual business performance as reflected in your bank statements, rather than requiring tax returns or W-2s.

A Streamlined Path to Approval

With flexible credit score requirements, high LTV options, and large loan amounts, the Bank Statement Loan Program offers a business-friendly mortgage solution that matches your real-world income situation. Whether you’re expanding your portfolio or purchasing your dream home, you’ll get a faster, simpler approval process.

.png)