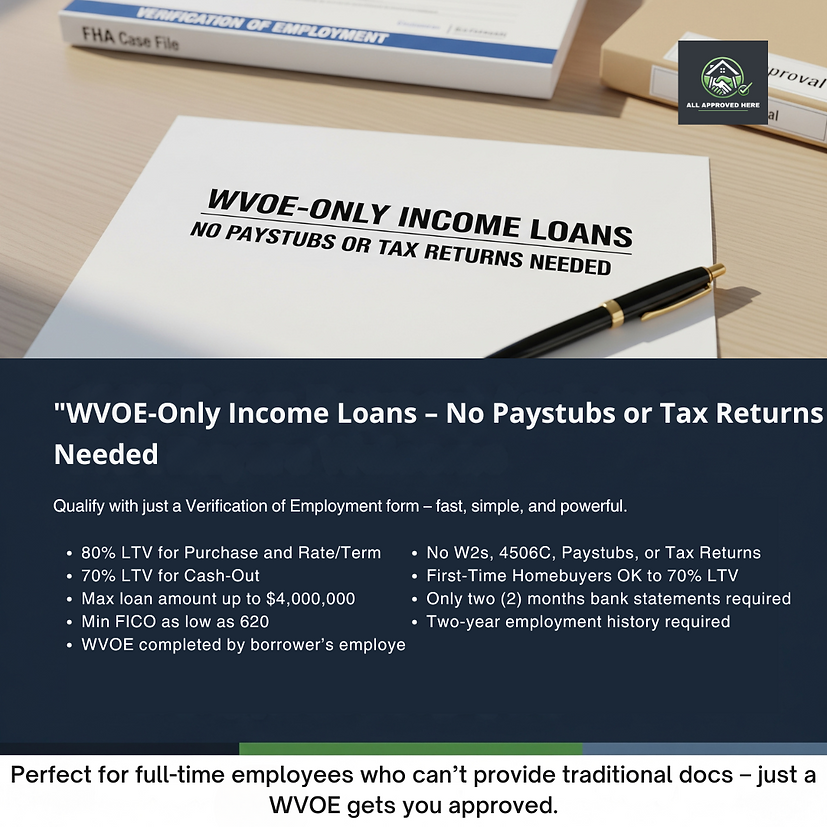

WVOE-Only Income Loans – No Paystubs or Tax Returns Needed

Fast, Simple, and Powerful Home Financing Without Traditional Paperwork

For qualified buyers who can’t provide standard income documentation, this program uses a simple Verification of Employment form to get you approved — no W-2s, paystubs, or tax returns required.

.jpeg)

FAQs

Q: What does WVOE stand for?

A: WVOE means Written Verification of Employment. It’s a form completed by your employer to confirm your job and income.

Q: Who can qualify for this program?

A: Full-time employees with a steady employment history, including those who don’t have traditional income docs like tax returns or

recent paystubs.

Q: What’s the minimum credit score required?

A: 620 FICO.

Q: How much can I borrow?

A: Up to $4,000,000 depending on the property type and LTV.

Q: Are first-time homebuyers eligible?

A: Yes, first-time buyers can qualify for up to 70% LTV.

Q: How much employment history do I need?

A: At least two years with your current employer or within the same field.

Why This Program Works

This program is perfect for borrowers who have solid employment but lack traditional proof of income. With a streamlined verification process, you avoid the delays of gathering tax returns and paystubs. Approval is based on employment confirmation, not extensive documentation, which can get deals closed faster. High loan amounts, competitive LTVs, and flexibility for first-time buyers make it a strong alternative to traditional loans.

A Smarter Way to Secure Your Home Loan

If you’re a full-time employee with consistent work history but missing standard paperwork, this program keeps your purchase or refinance moving. With minimal documentation, higher LTVs, and quick processing, you can focus on your new home — not chasing down old tax records. It’s financing made for today’s workforce.

.png)