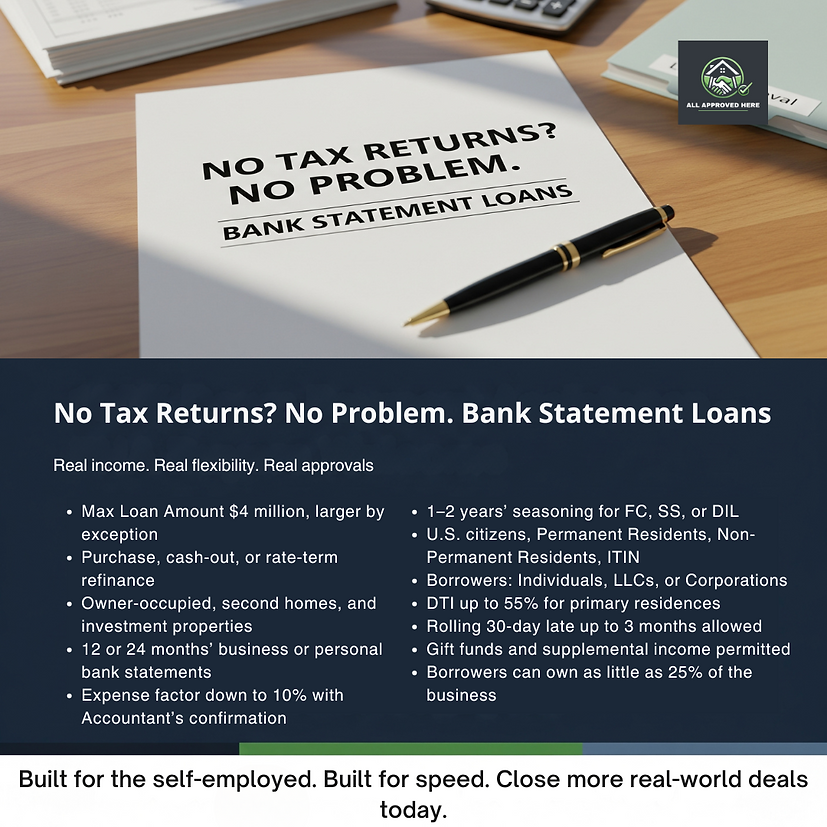

No Tax Returns? No Problem. Bank Statement Loans

Real income. Real flexibility. Real approvals.

A flexible lending option for self-employed borrowers, business owners, and investors who want to qualify based on bank statements rather than traditional tax returns — perfect for those whose reported income doesn’t reflect their actual cash flow.

FAQs

Q: What’s the maximum loan amount?

A: Up to $4 million, larger by exception.

Q: What types of transactions are eligible?

A: Purchase, cash-out refinance, or rate-term refinance.

Q: What property types are allowed?

A: Owner-occupied, second homes, and investment properties.

Q: How much bank statement history is required?

A: 12 or 24 months of business or personal bank statements.

Q: Is there an expense factor?

A: As low as 10% with an accountant’s confirmation.

Q: Who can qualify?

A: Individuals, LLCs, or corporations — U.S. citizens, permanent residents, non-permanent residents, and ITIN borrowers.

Q: What about credit and debt-to-income ratios?

A: DTI up to 55% for primary residences; rolling 30-day late up to 3 months allowed.

Q: Can gift funds or supplemental income be used?

A: Yes, both are permitted.

Q: Can partial business ownership qualify?

A: Yes, borrowers can own as little as 25% of the business.

Why This Program Works

This program removes the roadblocks that many self-employed borrowers face when applying for a mortgage. Instead of relying on potentially low taxable income from tax returns, it uses actual cash flow shown in bank statements. Flexible qualifying guidelines, high loan limits, and multiple property type eligibility make it an ideal choice for entrepreneurs and investors. With options for lower expense factors and acceptance of a wide range of borrower profiles, approvals are faster and more accessible.

A Smarter Way to Fund Your Business or Home Purchase

Bank statement loans provide a realistic and adaptable path to homeownership or investment funding for today’s self-employed borrowers. Whether you’re growing a business, expanding your property portfolio, or simply looking for a better fit than traditional underwriting, this program delivers. Enjoy faster approvals, tailored solutions, and the ability to use your real income picture — not just your tax return numbers. This is lending built for the way modern entrepreneurs work and earn.

.png)