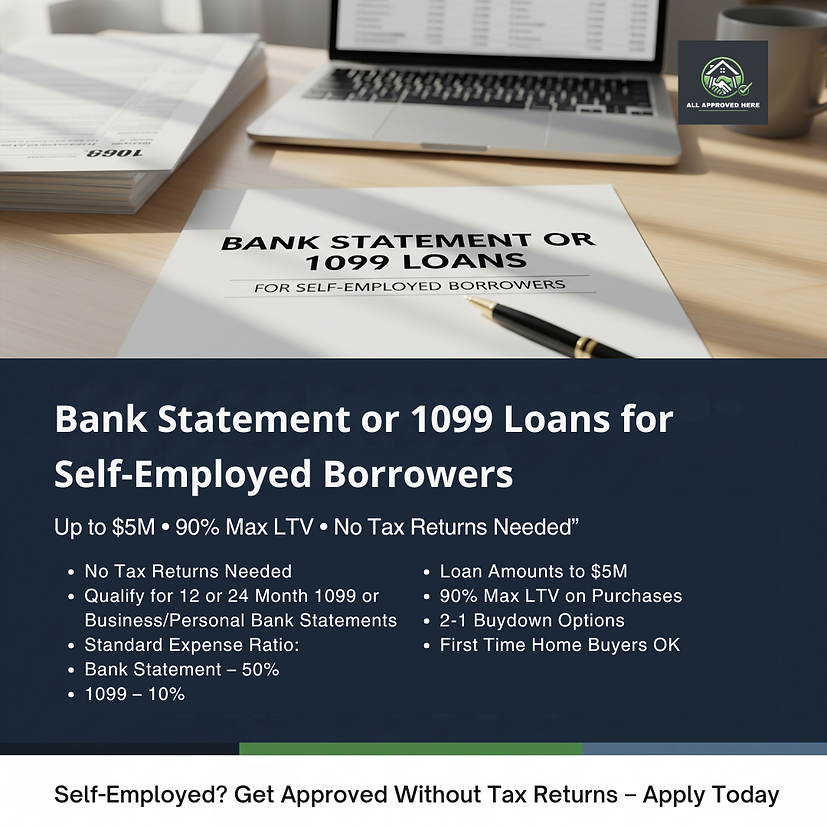

Bank Statement or 1099 Loans for Self-Employed Borrowers

Qualify Without Tax Returns — Flexible Income Documentation

Our Bank Statement or 1099 Loan program is designed for self-employed borrowers and independent earners who want a faster, simpler way to qualify for a mortgage. You can get approved using 12 or 24 months of business or personal bank statements or 1099 forms — no tax returns required. With high LTV options, large loan amounts, and the ability to use business funds, gift funds, or equity gifts, this program offers unmatched flexibility for entrepreneurs and freelancers.

FAQs

Do I need to provide tax returns?

No — bank statements or 1099s are all that’s needed.

What’s the maximum loan amount?

Up to $5 million.

Can I use business funds for my down payment?

Yes — business funds, gift funds, and equity gifts are allowed.

Is this program open to first-time homebuyers?

Yes — first-time buyers are eligible.

Why This Program Works for Self-Employed Borrowers

Tax returns don’t always show the full financial strength of self-employed individuals. This program lets you qualify based on actual bank deposits or 1099 income, making the process easier and more accurate for entrepreneurs.

Program Highlights:

-

No tax returns needed

-

Qualify using 12 or 24 months of 1099 or bank statements (business or personal)

-

Standard expense ratio: Bank Statement – 50%, 1099 – 10%

-

Loan amounts up to $5M

-

90% max LTV on purchases

-

2-1 buydown options available

-

First-time homebuyers welcome

.png)